Council Briefing: Initial Forecasts Show Significantly Larger Regional Power Demand for EVs and Data Centers in Years to Come

During March meeting in Portland, the Council’s Power Committee explored new data, discussed impact these trends could have

- March 19, 2024

- Peter Jensen

Since 2000, the Pacific Northwest has added almost 4 million new residents and its economy has grown significantly as major industries like tech have sprung forth while others, such as aluminum manufacturing, have vanished entirely. However, one constant has remained: The region’s overall annual power consumption over that time has been mostly flat at 20,800 average megawatts. This is due in large part to the success of energy efficiency measures. But new data on electric vehicles, data centers, and computer chip manufacturing suggests a shifting trend. Power demand in these sectors is growing, and over the next five years this demand could grow substantially.

During its March 12 meeting in Portland, the Council’s Power Committee explored the new data and discussed what impact these trends could have on the regional power system. It’s important to note that EVs, data centers, and chip manufacturing are only portions of a much larger energy consumption picture. The Council is currently working to develop two load forecasts – one looking out to 2029, as well as a longer-term forecast extending out 20 years – that will capture potential changes in energy use more comprehensively, including industrial, transportation, residential, and commercial.

The Council will use both forecasts to ensure that the Northwest continues to enjoy an adequate, economical, efficient, and reliable power supply. The Council will use the short-term forecast in the upcoming adequacy assessment to inform any updated recommendations to the region’s energy providers. It will use the long-term forecast to help develop the next power plan; this multi-year process is scheduled to officially kick off in 2025. The short-term forecast is slated to be presented to the Council at its May 14-15 meeting in Portland. The long-term forecast model is expected to be completed and released over the summer, with plans for further updates to take place over the coming year.

At the March 12 meeting, the Power Committee heard briefings and presentations from Council Analysts Steve Simmons, Dor Hirsh Bar Gai, and Dylan D'Souza (watch video), as well as from Amber Riter, Principal Financial Analyst with Portland General Electric, Mark Symonds, Manager, Load Forecasting & Analysis with Bonneville Power Administration, and Council Analyst Tomás Morrissey (watch video).

The briefing also touched on growth in rooftop solar, which will help to offset some of the appetite for more electricity in other sectors. More of these projects are adding battery storage, further lessening demand on power grids, D’Souza said. In Oregon, at the beginning of 2023, 5% of projects included storage. That increased to 10% by the end of the year. If built out to their full potential across the region, these small-scale projects could generate roughly 4,000 megawatts of power, on average, each year.

Tracking growing power demand

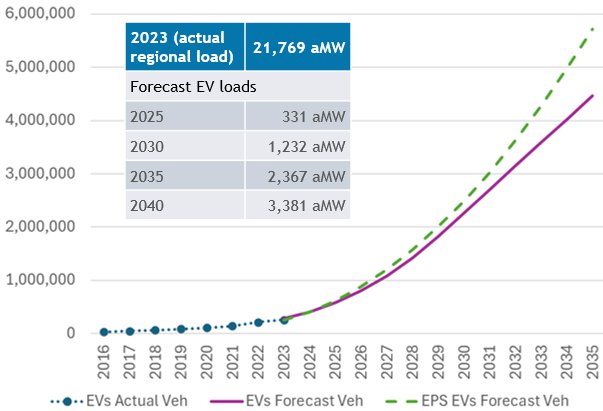

As a result of consumer demand in Seattle and Portland, Washington and Oregon accounted for approximately 95% of the electric vehicles registered in the Pacific Northwest at the end of 2023, Simmons told the committee. EVs are still a small portion of vehicles overall – for example, they’re just 2% of the 8 million registered in Washington state last year – but are growing quickly. They accounted for 29% of the new vehicles registered in the state in January 2024, according to state data.

“We are seeing really strong growth in EV registrations in the region, primarily in Seattle and Portland,” Simmons said.

Electric Vehicle Forecast

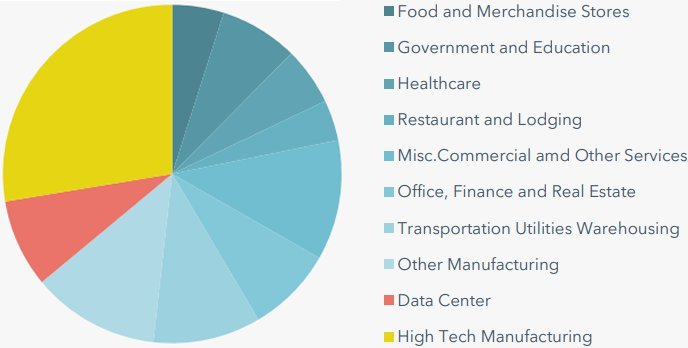

At the same time, the Northwest has also seen booming interest from tech corporations seeking to locate and expand data centers and chip manufacturing. Oregon’s “Silicon Forest” region – in and around Hillsboro outside of Portland – and Idaho’s Treasure Valley are two such examples, although the interest is extending throughout the central and eastern regions of Washington and Oregon. In Oregon, Riter said PGE attributes this interest to abundant clean energy supplies, low tax burdens, favorable costs of living, and other incentives. As a result, PGE’s energy demand from industry is projected to almost double over the next decade, according to the utility.

Share of 2023 C&I Energy Deliveries

In Idaho, tech giant Meta recently announced plans to build an $800 million data center in Kuna, south of Boise. Micron is also undertaking a record-breaking $15 billion expansion of its facilities in Boise to support chip fabrication operations – the largest private investment in state history.

This proliferation of power-hungry industries in the region reminded some members of the Power Committee of the growth of the Northwest’s aluminum industry in the 20th century, when smelters could run round-the-clock in the Columbia Basin fueled by cheap, abundant hydropower.

“We have seen this movie before,” said BPA’s Mark Symonds. “This will have a different set of challenges.”

Members questioned whether the tech companies would be willing to ease some of this burden by embracing demand-response measures that flex power use, by adopting higher energy efficiency, or through on-site generation. Symonds said those could be opportunities, but their extent may be tempered by the companies’ needs for extremely high levels of energy reliability.

Utilities across the Northwest are also busy constructing new infrastructure and generating resources, primarily wind and solar.

“There’s a lot of uncertainty and the impacts are indeed profound from what we’re seeing,” Symonds said. “There’s a lot of shovels moving, there’s a lot of infrastructure being built. It’s currently a matter of, is it going to keep going, is it going to accelerate? Those are key questions at the moment."

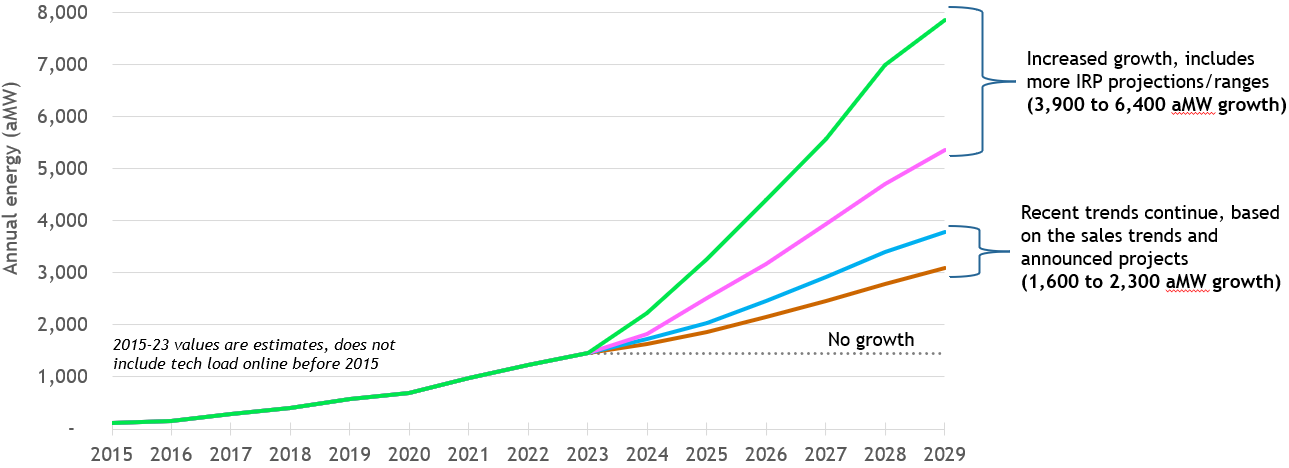

Draft data center and chip fabrication load backcase and forecast to 2029

To better understand and best address these potential impacts, the Council is planning to continue to work with its Demand Forecasting Advisory Committee, regional utilities, and the public to research and explore opportunities to bolster energy efficiency and demand response at data centers and chip manufacturers.